what is maryland earned income credit

The plan would give larger tax credits to married couples in order to counter whats been called a marriage penalty Rachidi. They were issued in 2020 and early 2021.

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Log Out If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

. Eligibility and credit amount depends on your income family size and other factors. To reduce the tax burden on low and moderate income workers. It has had strong support from Presidents Reagan Bush Sr and Clinton.

Photo Credit Thinkstock. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Federal EITC Information EITC Information in Spanish Common EITC Questions and Answers EITC Assistant.

In Maryland stimulus checks have begun going out to lower-income people who are US. Start filing for free online now. 50954 56844 married filing jointly with three or more qualifying children 47440 53330 married filing jointly with two qualifying children 41756 47646 married filing jointly with one qualifying child 15820 21710 married filing jointly with no qualifying children.

The EIC was enacted in 1975 and expanded in1986 1990 and 1993. The Earned Income Tax Credit. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following.

BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of.

It is a special program for low and moderate-income persons who have been employed in the last tax year. Ad Over 85 million taxes filed with TaxAct. Some taxpayers may even qualify for a refundable Maryland EITC.

It helps reduce the amount owed on taxes and can even result in a refund. Marylanders would qualify for these payments who annually earn. 50954 56844 married filing jointly with three or more qualifying children 47440 53330.

Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of Maryland. By design it is meant to benefit working families more than workers without children who qualify for the EITC credit. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. In some cases the EIC can be greater than your total income tax bill providing an income tax refund to families that may have little or no income tax withheld from. Calculate your federal EITC.

Find out what to do. Only those who work during the year could receive the credit. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021.

An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. Geared primarily towards low-to-middle income working individuals and families the Earned Income Tax Credit EITC is a federal benefit able to provide relief to those. The program is administered by the Internal Revenue Service IRS and is a major anti-poverty initiative.

Thelocal EITC reduces the amount of county tax you owe. Ranges from 25 to 45 percent of federal. IFile 2020 - Help.

HOME Resources Find Free Tax Assistance In Maryland Earned Income Tax Credit EITC is a tax benefit for low-and moderate-income workers worth up to 5751 for families. Allowable Maryland credit is up to one-half of the federal credit. You may claim the EITC if your income is low- to.

It can reduce your federal taxes possibly to zero. People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return. The Maryland earned income tax credit EITC will either reduce or eliminate.

Senate Bill 218 extends the tax credit to people who pay taxes using Individual Taxpayer Identification Numbers ITINs for the 2020 2021 and 2022 tax years. The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return. Find out what to do.

Filing your taxes just became easier. The state EITC reduces the amount of Maryland tax you owe. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

Did you receive a letter from the IRS about the EITC. The state income tax rates range from 2 to 575 and the sales tax rate is 6. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund. What is the Earned Income Credit. R allowed the bill to take effect without his signature.

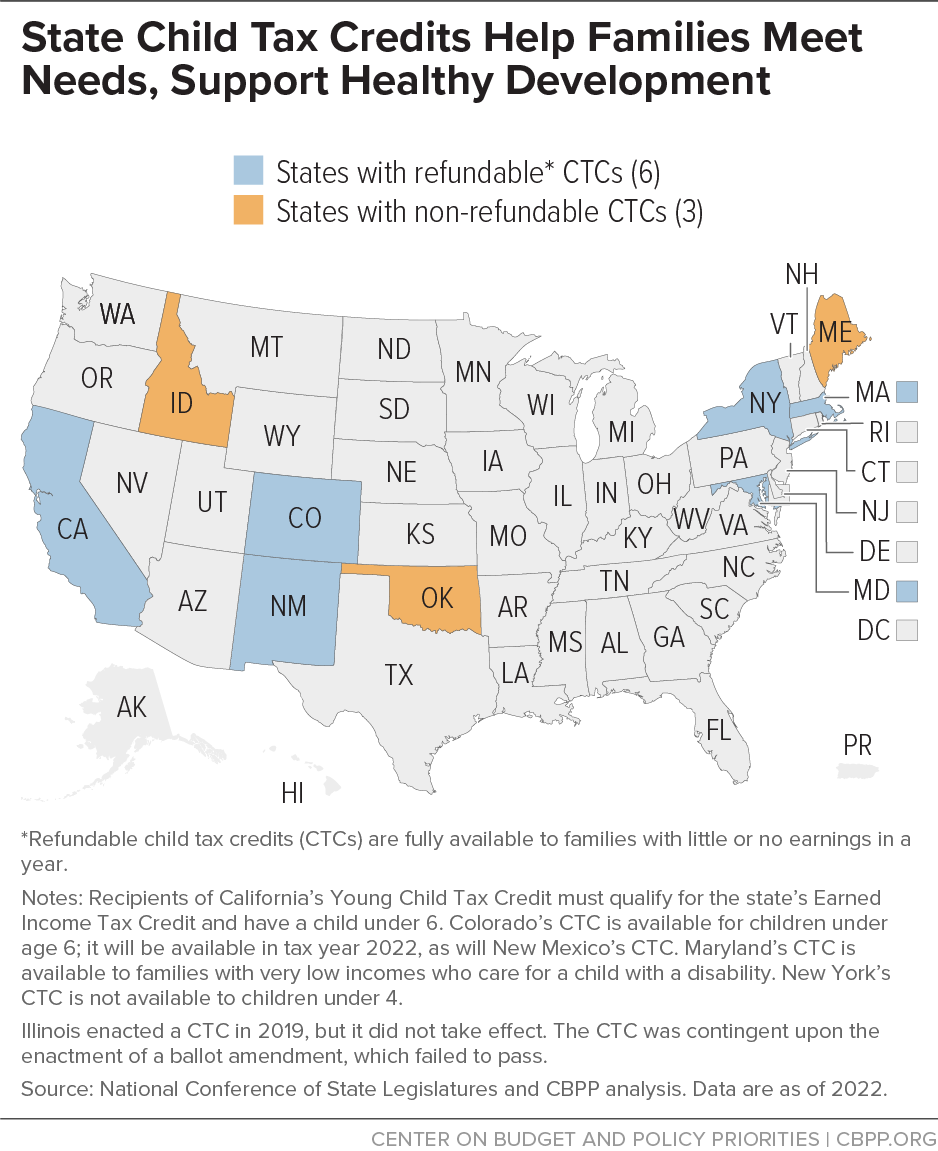

Updated on 4152021 to include changes for Relief Act 2021. The bills purpose is to expand the numbers of taxpayers to whom the Earned Income Credit EIC is available and to provide for a new Maryland Child Tax Credit. Maryland offers tax deductions and credits to reduce your tax liability including a standard deduction itemized.

Some taxpayers may even qualify for a refundable Maryland EITC. 1 day agoRachidis proposal completely replaces the child tax credit and the earned income tax credit while eliminating the head of household filing status. The Comptroller began accepting tax year 2020 returns for processing prior to the enactment of SB218.

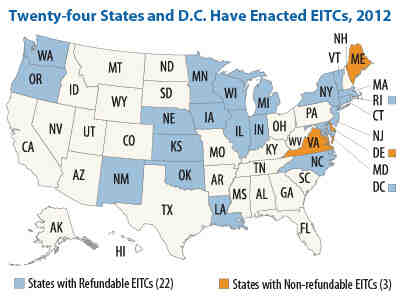

States and Local Governments with Earned Income Tax Credit States and Local Governments with Earned Income Tax Credit More In Credits Deductions. File your taxes stress-free online with TaxAct. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

Earned Income Tax Credit. If you claimed an earned income credit on your federal return or would otherwise have been eligible to claim an earned income credit on your federal return but for you or your spouse filing with an individual taxpayer identification. The earned income tax credit is praised by both parties for lifting people out of poverty.

You may qualify for extra cash back from the IRS. The state EITC reduces the amount of Maryland tax you owe. The maximum federal credit is 6728.

That group of. The Earned Income Tax Credit also known as EITC or EIC is a benefit designed to support low- to moderate-income working people. Thelocal EITC reduces the amount of county tax you owe.

The largest credit amounts go to families with two or more children and household income between about 12000 and 15750.

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

How Do State Earned Income Tax Credits Work Tax Policy Center

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

State Earned Income Tax Credits 2008 Legislative Update Center On Budget And Policy Priorities

Irs Child Tax Credit Payments Start July 15

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

An Orange County Shareholder Disputes Lawyer Can Provide Assistance In Situations Where Co Own Funny Marriage Advice Marriage Advice Cards Best Marriage Advice

Earned Income Tax Credit Now Available To Seniors Without Dependents

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Maryland State 2022 Taxes Forbes Advisor

How Older Adults Can Benefit From The Earned Income Tax Credit

How To Get Up To 3 600 Per Child In Tax Credit Ktla

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Earned Income Tax Credit Who Qualifies Changes For 2022

Money Make Money Love Money Cash Cash Money Euro Dollar Euros Dollars Money Cash Cashback Money Cash Money Stacks Rich Money

Child Tax Credit Schedule 8812 H R Block

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center